According to reports on Oct. 10, 2017, Wal-Mart Stores Inc.’s most recent prediction is that they expect little reduction in the pace of its hot e-commerce gain next year. This sent shares up on Tuesday by 2 percent. Slow to catch up with its competitors at Amazon Inc., the world’s largest brick-and-mortar retailer has been on a tear in recent quarters.

The help of the $3 billion acquisition of Jet.com, an overhaul of its marketplace, and better integration of its stores with its digital business resulted in an increase of 60 percent in U.S. e-commerce sales. In the fiscal year, ending in early 2019, the company says domestic e-commerce should grow by 40 percent.

This should send the stock up 4.7 percent in two years. The overall net sales will rise by at least 3 percent. In the same period, the company will buy back $20 billion worth of its own shares over the next few fiscal years. At its annual investor meeting in Arkansas, Walmart recapped plans to focus on e-commerce business.

Last year, Jet.com CEO Mark Lore was selected by Walmart to increase its U.S. efforts, after online sales growth had declined under his forerunner. Smaller e-commerce players like Moosejaw, Bonobos, and Modcloth were all a part of the company’s purchases.

Walmart Stores CEO Doug McMillan said, “We’re combining the accessibility of our stores with eCommerce to provide new and exciting ways for customers to shop.”

Express lanes for drug prescription pick-ups and merchandise returns are ways the company has shown it has enhanced its customer services.

They have been constantly reinforcing different ways to mix digital with the stores. Another resource they are offering online shoppers, is a discount for picking up an order in the store. At 1,000 out of 4,700 of its stores in the U.S, they now have grocery pick up. This makes them more competitive with retail rivals like Amazon’s Prime Now.

The company plans to open less than 15 SuperCenters in the U.S. next year, having additional physical facilities will help with its roughly $15 billion a year e-commerce business.

Although the company did not break out the e-commerce sales from last year, they expect sales to reach up to at least $11.5 billion by the end of January, in the 2018 fiscal year.

Moody’s retail analyst Charlie O’Shea feels that Amazon’s advantage in the online market will be difficult to overcome. That being said, by elevating its unmatched physical resources, Walmart is able to stand out over other retailers.

They are boosting shares of the world’s largest brick-and-mortar retailers to the top over two years. The best drivers of benefit in the Dow Jones Industrial Average closed at $84.13.

In a webcast at the Bentonville, Arkansas company’s annual investor meeting, Walmart Chief Financial Officer Brett Briggs said that the company is going to focus more on the technology, international stores, and e-commerce.

Written by Antwon Rogers

Edited by Jeanette Smith

Sources:

Fortune: Walmart Says Its Online Sales Will Explode Next Year Amid War With Amazon

Reuters: Wal-Mart sees 40 percent online sales growth next year, shares rise

Washington Post: Walmart looks to see if virtual shopping is better than the real thing

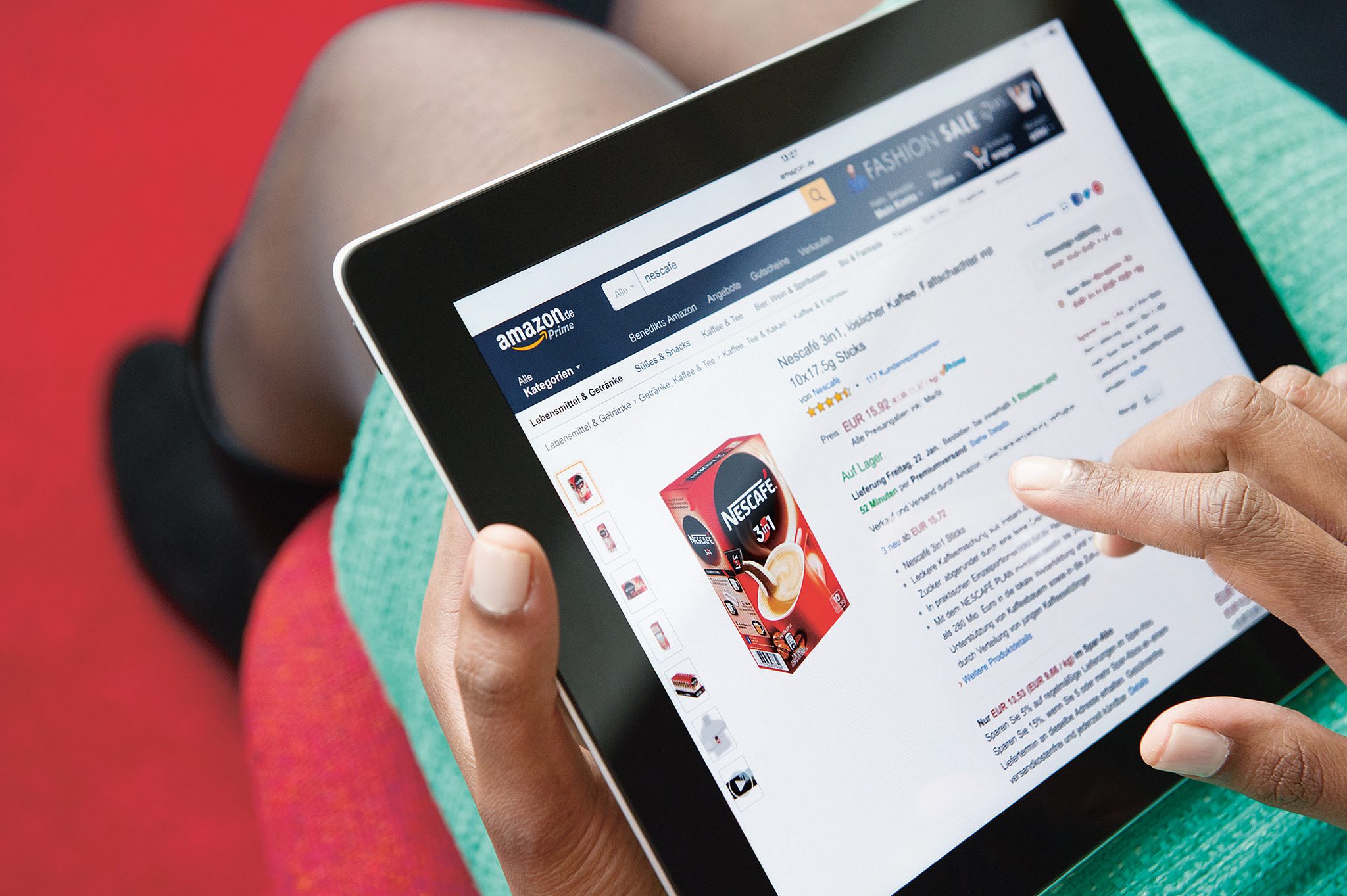

Featured and Top Image Courtesy of Nestlé’s Flickr Page – Creative Commons License